As an investor, you may wish for options that give you stability and growth. But is it right that high-value stocks are the only ones in this category? Well, in reality, there are a few hidden gems that are often missed by even experts. These are the small-cap stocks.

Now, the question here is, how can you find these undervalued or undiscovered small cap stocks easily? Well, if you are an investor looking for your next pick, read this guide to learn how to find some hidden high-value stocks.

What Are Small Cap Stocks?

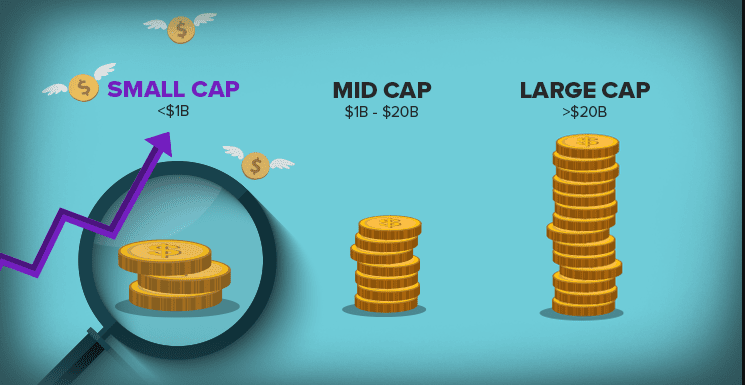

Small cap stocks are the shares of companies with a market cap of less than ₹5,000 crores. If you consider their ranking, it starts from 251 in terms of market cap.

These companies are usually younger, less established, and operate in niche markets. While small caps can deliver outsized returns due to their growth potential, they are also more volatile and riskier than large-cap stocks.

Finding Undervalued or Undiscovered Small Cap Stocks

It is not an easy task to find the undervalued or undiscovered small cap stocks to invest in. You really need to work hard. But here are a few steps that would help you greatly:

1. Start with the Nifty Smallcap 250 Index

You can go with the Nifty 250, or rather, the Nifty Smallcap 250. Now, these are companies from 251 to 500 ranked by market cap. These are the companies with a good standing. They can offer you liquidity and good returns when evaluated properly. You must evaluate these companies deeply based on various factors.

2. Use Screening Tools with Custom Filters

You need to check the strength of these options. For these, multiple ratios and numbers need to be checked out. Some of the top ones that you can check are:

- Low Price-to-Earnings (P/E) ratio

- High Return on Equity (ROE)

- Positive Free Cash Flow

- Low Debt-to-Equity ratio

These filters help surface undervalued companies with strong fundamentals.

3. Look Beyond the Numbers

Having the names is just the starting point. You would now need to check further details. Their annual and quarterly reports are a great source for you. You can check their investor presentations too. Look at the business model. See if it is scalable? Are they entering new markets? Are promoters increasing their stake? These signs often indicate confidence and potential.

4. Focus on Niche or Emerging Sectors

Small caps in sectors like specialty chemicals, defence, clean energy, or niche manufacturing often get less attention. However, these are the ones that can offer you benefits based on their long-term structural trends. Identifying companies aligned with broader economic or regulatory shifts can give you an edge.

5. Track Promoter Holdings

If the promoters are buying more shares, this is a good sign. This means they trust that the company will grow in the near future. But if you find regular pledging or selling, be cautious. There might be some uncertainty in future growth.

6. Avoid Common Pitfalls

Not every small cap stock is a hidden gem. Watch out for companies with poor governance, sudden spikes in stock price without business updates, or overly complex business structures. Volatility and risk are part of the game, but poor due diligence can lead to major losses.

Conclusion

Finding undervalued small cap stocks is quite a calculated process. It starts with disciplined research, clear financial filters, and a sharp eye for real growth. Track the Nifty small-cap companies to build a strong watchlist and study their business models and promoter activity. Stay away from hype and focus on quiet performers with solid fundamentals.