Urbanization is one of the most transformative forces shaping the future of cities in India. As millions of people are moving to urban cities in search of better employment opportunities, living conditions, and a higher quality of life, the demand for commercial and residential properties are significantly increasing.

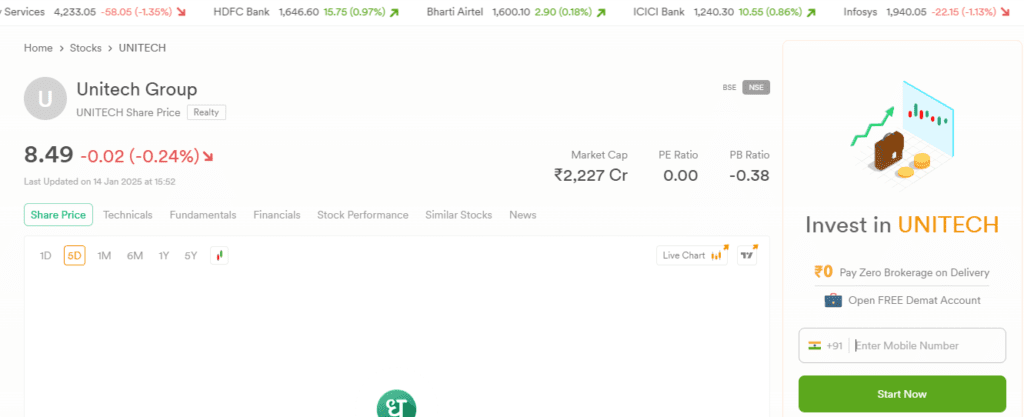

This is beneficial for real estate developers like Unitech because they can use it to position themselves in the Industry. In this blog, we’ll delve deep into how Unitech can deliver good returns due to the urbanization boom. Let’s begin!

5 Factors that Could Drive Good Returns Amidst Urbanization Boom

Here are five factors that can drive returns for Untech –currently one of the many penny stocks under 20 rs, due to the urbanization boom.

1. Prime Land Bank and Strategic Locations

Unitech has some prime land holdings in India’s high-urban growth centers including Delhi NCR, Mumbai, etc.

These locations are witnessing massive urban development and will have a growing demand for both residential and commercial spaces.

Since Unitech has lands in these areas, it can develop multiple projects to target diverse market segments, including luxury apartments and affordable housing.

This diversification approach can help them reach a wide range of buyers, ensuring consistent sales.

Hence the value of Unitech Land holding is going to increase drastically, which will also impact its share price.

2. Urban Infrastructure Developments

With growing urbanization, the Indian government and private organizations are heavily investing in urban infrastructure, including highways, metros, and water and waste management.

Government’s main aim is to build world-class infrastructure through the Smart Cities Mission. Projects are to make lands more accessible, affordable, and desirable for both residential and commercial use.

Hence, this constantly improving infrastructure and connectivity can make Unitech’s properties more attractive and positively impact Unitech share price. It will increase the demand for real estate, especially for the previously underserved locations.

3. Residential Demand

The growing middle-class Indian population has represented a huge demand for affordable housing.

The government has also launched many schemes like Pradhan Mantri Awas Yojna (PMAY) to focus on providing homes to economically weaker section groups.

Moreover, due to increased urbanization, people’s expectations for modern amenities are also rising. Amenities may include security, parking spaces, and recreational facilities.

Due to this large demand for apartment and independent houses, real estate developers like Unitech, who have the ability to meet all demands, will experience the most benefits.

4. Commercial Real Estate

India’s thriving startup ecosystem and the expansion of multinational corporations have significantly increased the demand for office spaces, particularly in urban hubs.

The construction of large-scale office complexes, IT parks, and business hubs is witnessing in Noida, Gurugram, and Bengaluru—key areas where Unitech is actively involved.

Unitech can also focus on creating more co-working spaces, as they are more in trend. This can allow them to earn higher yields and quicker returns as compared to traditional office spaces.

5. Government Support

The Indian Government has introduced many policies to encourage urbanization and growth in the real estate sector due to seeing increased urbanization and people’s interest in buying more properties – commercial and residential both.

This is beneficial to Unitech who work in both the premium and affordable housing segment.

Moreover, tax incentives and subsidies offered by the government under PMAY (Pradhan Mantri Awas Yojna) and other schemes can make projects financially viable for developers. These government programs also increase Unitech’s share, enabling it to deliver attractive returns.

Conclusion

In summary, urbanization can create various factors that can help Unitech grow as a commercial and residential property developer. This enhanced business will have a positive impact over Unitech share price. Hence, it can be a good time to invest in this company.