If you’re diving into the world of algorithmic trading, you might be wondering what sets BankNifty algos apart from other index algos, such as those for the Nifty 50. Many indices are popular in India, but BankNifty algo trading has unique traits that make it special and potentially lucrative. In this article, let’s explore what makes BankNifty algos different and how you can leverage this knowledge for smarter trading.

What is Algo Trading for BankNifty?

Algorithmic trading, also known as algo trading, refers to the use of computer programs to automatically execute buy or sell orders based on pre-set rules. BankNifty is an index that tracks the stocks of 12 major Indian banks, and an algo trading strategy for BankNifty options acts faster than you could manually. They scan real-time market data, spot price moves, and execute trades within microseconds. This speed can beat human reaction time and help capture quick profits in volatile markets.

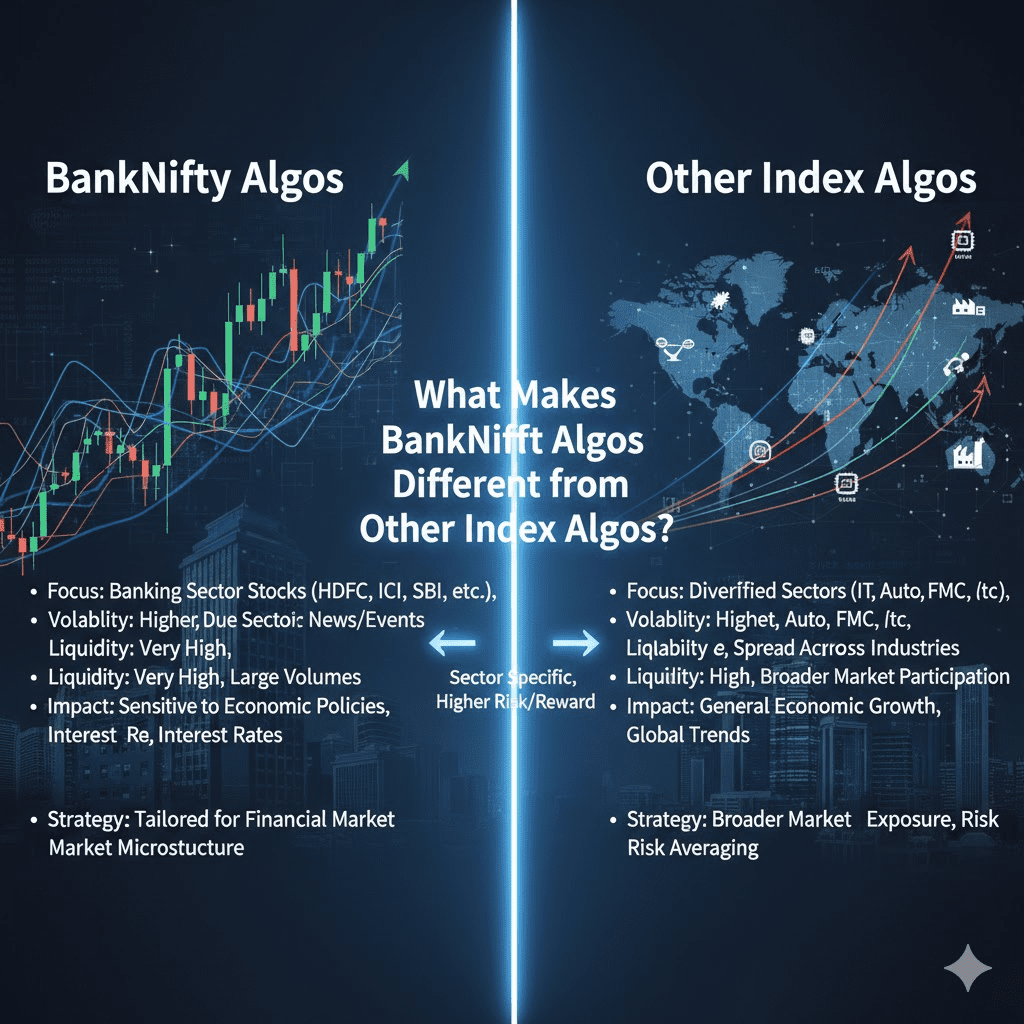

While Nifty algos focus on the broader market of 50 large Indian companies, BankNifty algos zoom in on the banking sector. This sector-specific focus means BankNifty algos handle different volatility patterns and price behaviours compared to other index algos.

Why BankNifty is More Volatile and How That Shapes Algos?

BankNifty is generally more volatile than the broader Nifty 50 index. This is because financial stocks react sharply to changes in interest rates, RBI policies, and news about credit growth. As a result, BankNifty sees larger price swings on intraday charts.

Your BankNifty algo must be built to handle these swings smartly. Unlike more stable index algos, BankNifty algos use tighter risk management and dynamic stop-loss levels. The goal is to profit from sharp moves but quickly cut losses if the market turns against you.

For example, many BankNifty algorithms use short timeframes, like 1- to 5-minute charts, to capture these fast moves. They also incorporate indicators sensitive to momentum changes like RSI or moving average crossovers, tailored specifically for BankNifty’s behaviour.

Sector Concentration and Liquidity Implications

Because BankNifty tracks only banking stocks, the algo functions within a more specific industry compared to Nifty algos, which diversify across sectors like IT, pharma, and energy. This means your BankNifty algo can sometimes predict moves driven by sector-specific news faster.

Also, BankNifty futures and options are among the most liquid derivatives in India, allowing algos to execute large orders without disturbing prices much. High liquidity means less slippage, the difference between expected trade prices and actual execution prices, which is crucial for algorithmic performance.

Algorithm Complexity and Backtesting

BankNifty algos are often designed with complex strategies tailored to the index’s unique traits. Developers backtest these algos extensively against historical BankNifty data to understand how they would have performed through various market cycles. This backtesting includes stress scenarios like rate hikes by the RBI, financial crises, or changes in bank earnings. The results help refine algorithms so they limit losses and optimise entry and exit points for trades.

Many platforms also allow you to tweak parameters to adjust aggressiveness or risk tolerance based on your trading style. Backtesting and optimisation are necessary to make your BankNifty algo robust under different market conditions.

Key Takeaways for You as a Trader

- Understand Volatility: BankNifty’s higher volatility means algos need tighter risk controls and faster reaction times than general index algos.

- Focus on Sector News: Since BankNifty is bank-heavy, keeping an eye on banking sector developments enhances algo effectiveness.

- Use Backtested Strategies: Trust algos that are rigorously tested on historical BankNifty data, including stressed market conditions.

- Consider AI Algos: Explore AI-powered options for getting smarter signals that adapt as market dynamics shift.

- Liquidity Advantage: High liquidity in BankNifty derivatives means your trades get executed quickly at desired prices, which benefits algorithmic strategies greatly.

Conclusion

BankNifty algos stand out from other index algos because they are designed specifically for a more volatile, sector-focused market with unique trading patterns. They combine speed, precision, specialised indicators, and robust risk management to seize fast-moving opportunities in India’s banking sector.

As an investor or trader, understanding these differences lets you choose or build algos that fit BankNifty’s traits, helping you trade smarter and more profitably. With careful strategy design and disciplined execution, BankNifty algos can be a powerful tool in your trading toolkit.